Tax Appeal Deadlines Approaching in Maryland and in the District Of Columbia: How to Appeal Real Property Tax Assessments

|

|

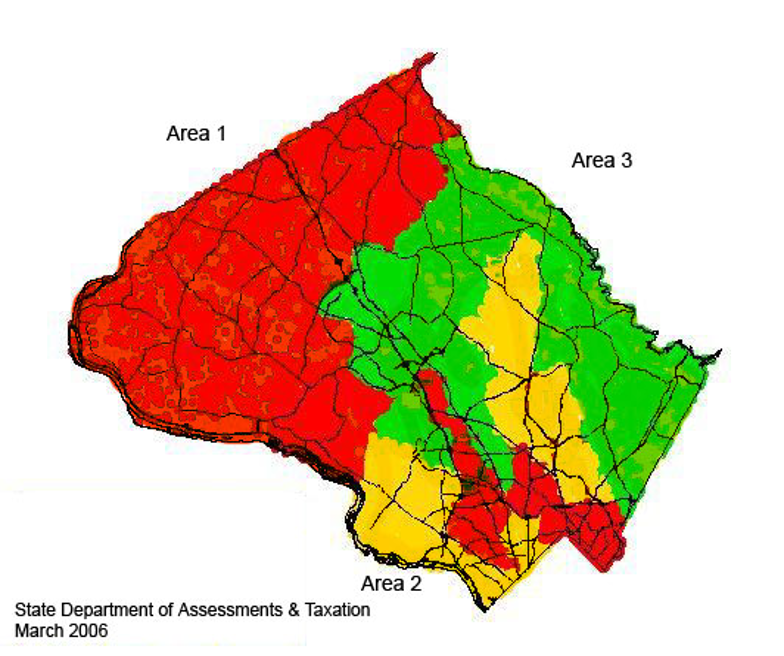

We are fast approaching the time of year when property owners in our area can expect to receive notices of their real property tax assessments. These notices will include an estimate of the current or fair market value of a property as determined by the taxing authority. If you disagree with your property’s tax assessment, you can file an appeal, as long as you do so timely. In determining whether you agree or not, it helps to first consider how the assessments are determined. The taxing authority takes one or more of three approaches to market value: sales approach, cost approach, and income approach. If a property is income producing, the methodology for assessment is typically the income approach. For newly constructed properties and residential properties, the sales or cost approach could be used. MARYLANDNotices. In Maryland, Notices of Assessment will be issued at the end of December. Here, real property is reassessed every three years with one-third of all properties in Maryland being reassessed each year. When property values increase, the increase is phased-in with equal increments over the following three years. The resulting tax increase is phased in over the course of the three years, so that the full and final taxes are paid in the third year. In Montgomery County specifically, some of the areas facing reassessment in 2025 include upper Montgomery County, as well as parts of Bethesda, Silver Spring, and Wheaton. These areas are shown in Area 1 of the below map. |

|

Assessment Area 1 will be reassessed for January 1, 2025. |

|

Once the notices are issued, if the property owner believes that the property value estimate is incorrect, the property owner may file an appeal to dispute it. Appeals are due within 45 days after the date of the Notice of Assessment. Appeals of assessed values can also be filed during a triennial period as a Petition for Review, or within 60 days of the transfer of property between January 1 and June 30. It is important to note that if events have occurred since the last regular assessment, which have caused a property to decline in value, a Petition for Review can be filed. A Petition for Review must be filed by the first business day in January. Appeal Process. There are three levels of appeals in Maryland. The first is the Supervisor’s Level, which is an informal meeting with an assessor from the State Department of Assessments and Taxation (SDAT). The second level of appeal is to the Property Tax Assessment Appeal Board (PTAAB), which is comprised of a 3-person independent appeal board made up of local residents with experience in real estate. An assessor from SDAT attends this hearing and presents the arguments as to why the assessment is accurate. The third level is an appeal to the Tax Court. The proceedings at this level are more formal than the other two, but are still less formal than a typical court case. Little discovery is permitted at this level, except for the ability to depose the assessor from SDAT. The property owner has the burden of proof in all three levels of appeal. THE DISTRICT OF COLUMBIANotices. In the District of Columbia, properties are reassessed annually. Notices of Proposed Real Property Assessment are sent out at the end of February, and appeals of those assessed values are due by April 1. A new owner typically has 45 days after the date of the property transfer to file an appeal. Appeal Process. Similar to Maryland, there are three levels of appeal in the District of Columbia. The first is an informal meeting with an appraiser from the Office of Tax and Revenue. The second is an appeal to the Real Property Tax Appeals Commission, and, as a final resort, the third is an appeal to the D.C. Superior Court. As in Maryland, the burden of proof that the assessed value is too high lies with the property owner. The attorneys at Selzer Gurvitch Rabin Wertheimer & Polott, P.C. can assist you with filing your assessment appeals and Petitions for Review in most counties in Maryland and in the District of Columbia. If you are uncertain as to whether your properties are being reassessed in 2025, or you wish to speak with an attorney about appealing your real property tax assessment, please contact Jessica Lieberman at jlieberman@sgrwlaw.com or (301) 634-3154. |